Future EU rules defining what constitutes a sustainable investment could soon become the global standard. With so much speculation around the greening of financial markets, what is the EU’s green taxonomy all about in the first place? And why does it matter for aviation’s ecosystem?

Starting this year, all asset managers operating within the European Union (including non-EU asset managers who are marketing their funds in the Union) are required to benchmark their disclosures against the criteria of the European taxonomy for sustainable activities. This is a watershed moment and a sign of the increasingly wider alignment of laws for environmental, social and governance (ESG) issues.

Amid the COVID-19 pandemic, ESG issues have become one of the most important shifts in the investment industry in a generation. Over the last decades, climate change concerns have increasingly spread around the world, supported by alarming scientific forecasts and environmental degradation — forcing a wider debate about how economic growth can coincide with environmental sustainability. Following the 2016 Paris Agreement and the UN’s CORSIA agreement for the mitigation of carbon emissions from aviation globally, the EU, in the middle of the pandemic, launched its European Green Deal — which besides aiming to reduce CO2 emissions in all the main economic sectors and reach carbon neutrality by 2050, will seek to favour investments in green technologies.

The EU taxonomy for sustainable activities is the standard developed within the Green Deal following the recommendations of the Sustainable Finance Platform (SFP). This is a selected group of international experts from across all sectors and disciplines who were charged with providing a common framework for action reflecting the interests of all the major market players.

In 2020, the group achieved through a consensual process to identify sustainability improvements across all stages of an economic activity, from mitigation to adaptation and innovation — rather than absolute values, focusing on an objective evidence-based environmental framework, so to marry industry and science. This approach is also likely to impact actors’ accountability towards citizens and the transparency of operations and investment decisions.

These standards will also influence the decisions of listed companies, who will find themselves under pressure to focus more on ESG issues or risk losing investor capital. European policymakers, in particular, have been keen to help direct cash to sustainable investments in an effort to meet national CO2 reduction targets.

As the EU aims at regulatory leadership, it will seek to influence global discussions by setting standards and accelerating the expansion of a market that drives profits and innovation along with sustainability. In its first report from March 2020, the expert group unfortunately fell short of addressing the aviation sector, for which a detailed taxonomy remains to be fully developed Final report of the Technical Expert Group on Sustainable Finance, March 2020. See here. . By the end of last year, “the world’s first-ever ‘green-list’” of economic activities aimed at encouraging private investments in the green economy therefore failed to consider most economic activities of the air transport sector. The updated draft delegated act currently under discussion by European lawmakers will only remotely touch upon relevant aviation decarbonization activities or projects.

For a capital-intensive sector at the heart of Europe’s economic and social development, and which recently committed to unprecedented climate goals, this cannot be left unaddressed.

Sustainable and transition investment categories in aviation

The taxonomy guidelines are aimed at steering private investors towards environmentally sustainable companies through detailed emissions thresholds which would define whether an economic activity can be considered “low carbon”. Other categories in the EU taxonomy include “transition” and “enabling” economic activities.

Due to the absence of technologically and economically feasible low-carbon alternatives in the aviation sector, and with the objective to meet our Destination 2050 commitments, aviation’s contribution to fight climate change and reduce emissions will have to be achieved by continuing to use kerosene in more fuel-efficient aircraft, progressively switching to fuels that are increasingly CO2 neutral whilst remaining cost-competitive. Because current aircraft technology does not support zero or low-emission flying and is unlikely to do so until the next decade, the decarbonization of air transport will have to count on these transition activities.

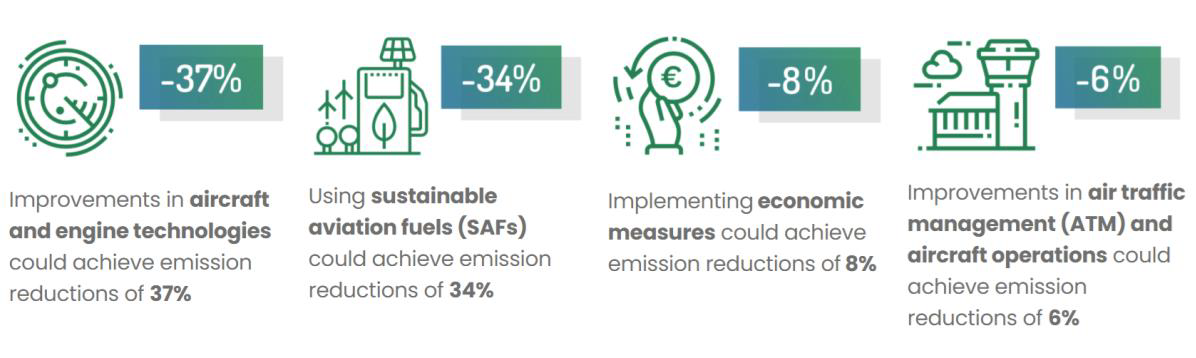

European aviation’s Destination 2050 roadmap sheds light on the challenges ahead to ensure aviation can contribute to meeting Europe’s 2030 and 2050 climate goals. It identifies a complex mix of measures and policies that will enable the success of the European Green Deal: aircraft engine efficiency, operational and ATM improvements, new aircraft propulsion technologies including electric, hybrid-electric and hydrogen- powered, and the use of Sustainable Aviation Fuels (SAFs).

Making the sector’s Destination 2050 vision a reality will not be achieved without the right regulatory framework and supporting investment conditions. Significant private and public capital will be needed to deploy and produce SAFs If the draft taxonomy rules refer to the manufacturing of biofuels (section 4.13), SAFs are likely to be more than a transitional technology for many air carriers when aiming for carbon-neutrality by 2050 and is therefore considered a robust long-term solution for decarbonising long-haul flights notably., ensure replacement of older aircraft with new, state-of-the-art fleets, adopt the technology capable of improving air traffic management (ATM) and operational performance This is notably the case for air traffic management (ATM) R&D and deployment, as per the European ATM Master Plan, for operational improvements and in the implementation of Free Route Airspace (FRA) and cross-border FRA. or ensuring innovative zero-emissions aircraft of tomorrow.

The financial investments – either public or private – supporting the deployment of the best technology available as identified by Destination 2050 must be included in the EU Taxonomy as transition activities. As the EC itself puts it, “there is a need to give reassurance that the taxonomy will not block access to finance for enterprises and sectors in transition towards our climate targets EC request to the Platform on Sustainable Finance to advise on how to exploit the full potential of and EU Taxonomy to support transition investment flows, 18 Jan. 2021. Link.”

A clear vision of what constitutes environmentally sustainable aviation activities is urgently needed, and that includes taking into account the key role that certain transition activities will play in the net zero transition. Combined with a balanced approach to monitoring and the avoidance of greenwashing, it would increase the attractiveness of investing in aviation for green finance investors – both for specific projects and for actors who have put decarbonization at the heart of their growth strategy.

For this reason, clear technical screening criteria to facilitate investments in sustainable projects and activities in aviation cannot wait. They will be crucial to enable the sector to embrace climate change mitigation as per its Destination 2050 commitments, thereby contributing to the European Green Deal, the Paris Agreement and its goal of limiting global warming to 1.5°C.

The global green bond issuance reached a record high of €225 billion by the end 2020 and could reach €300-€350 billion this year, possibly with the help of the taxonomy. In parallel, national central banks and large asset managers are raising the prospects of dropping companies failing to adopt 2050 net zero emissions goals. Yet, we are only experiencing the beginning of the greening of finance.

The transformation ahead is not minor. If the rules were to be applied in their current form, less than 2% of blue-chip companies listed in Europe would be considered “sustainable”. Framing investments into binary ‘green’ or ‘brown’ activities will not maximize the attraction to investors of green finance in the aviation sector and in other sensitive sectors of the economy. Recognizing the limits of a purist approach, clear technical criteria should embrace that change, be allowed to start slow, gather pace and eventually produce a radical difference.