Abstract

This paper sets out A4E’s position on Alphabet’s approach to comply with its Digital Markets Act’s (DMA) obligations, which are currently being investigated by the European Commission, and the possible consequences of the DMA implementation on airlines’ ticket distribution.

The aviation industry is deeply concerned that removing any distinction between airline and intermediary offers could result in an opaque and confusing distribution system for consumers which does not meet high consumer protection requirements and do not protect them from intermediaries’ abusive practices. In addition, it would deprive airline offers from fair representation both in the search phase and in the way metasearch engines (MSEs) display them thus granting a strong competitive advantage to intermediaries whose business models are still not sufficiently regulated.

Therefore, it is of upmost importance for the search design adopted by Google to bring clarity to the consumer by clearly distinguishing what constitutes airline and intermediary offers in the way they are displayed (e.g. through a “block” for airline offers). A4E also requests that the Commission acknowledges that a wrongful DMA implementation could open the gate to intermediaries’ unfair and misleading practices by giving their offers a greater representation at the expense of airline offers which are already being disfavoured both at the search phase and on MSE websites.

The European aviation industry fully supports and understands the need for the DMA to regulate gatekeepers’ unfair competition practices, notably self-preferencing abusive practices (article 6(5) of the DMA). Airlines have always supported and benefited from an integrated and competitive Single Market as it brings closer together citizens, businesses and governments across borders. Healthy competition also requires fair and contestable platform markets.

Although the intended scope of the DMA is gatekeepers, and not airlines per se, the consequences of the implementation of this text are broader and can have a significant impact on airlines’ ticket distribution. The European Commission has opened non-compliance investigations against Alphabet after raising concerns of a potential breach of the DMA rules on self-preferencing related to Google’s vertical search services (VSS). This investigation covers Google Flights and, more generally, the display of plane ticket offers. It is therefore of primordial importance to both carriers and consumers that our industry’s perspective is taken into careful consideration.

The lack of transparency on the nature of intermediaries’ offers negatively impacts consumers

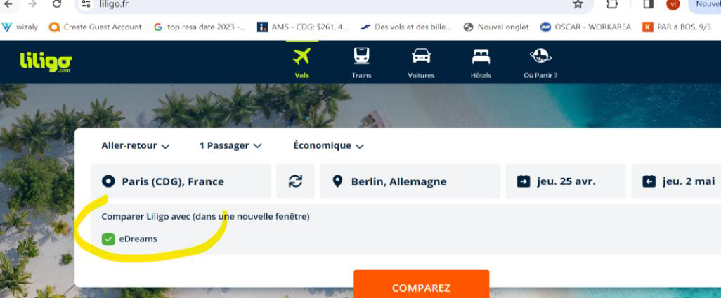

The intended purpose of the DMA is to offer qualitative “digital products and services” and to pursue high “quality or choice for business users” (Recital (25) of the DMA) Recital (25) of regulation (EU) 2022/1925 (DMA). Favouring intermediaries’ offers by implementing DMA rules without taking into account the need for a clear and distinct display of airlines’ offers goes against this purpose of offering high quality and wide-ranging services for consumers. The airline industry is indeed committed to having high consumer service quality standardsAirlines for Europe, Our Pledge, including through offering variety of choice or ensuring a great level of safetyIATA, Safety Leadership Charter. On the contrary, it has been a recurrent issue that intermediaries’ offers fail to meet consumer standardsRegarding the deficiency in the transfer of information: Cases C-302/16 Krijgsman and C-263/20 Airhelp; Regarding hidden prices: Ryanair Annual Report 2023, Item 8, Legal Proceedings Against Internet Ticket Touts. although various intermediaries are supposedly committed to few consumer protection requirementsEuropean Commission, Air Travel, Airline intermediaries: “three major online travel agencies (eDreams ODIGEO, Etraveli Group and Kiwi.com) committed to better inform consumers in the case of flight cancellations by airlines and to transfer ticket refunds received from airlines within seven days.”.

Another recurrent issue is the lack of transparency as to the content and type of offers displayed by MSEs and intermediaries. The difference between MSEs and Online Travel Agents (OTAs) is not specified nor explained in any EU legislation and is increasingly blurred, a lack of clarity deliberately cultivated by intermediaries. However, European consumers do have the right to receive information regarding the identity of the economic actor they are in contact with and the content of their offersDirective 2011/83/EU of the European Parliament and of the Council of 25 October 2011 on consumer rights. Therefore, removing the airline block as a result of the DMA implementation and having both direct suppliers and intermediaries’ offers displayed alongside without any visible and easily comprehensible distinction would only perpetuate this confusion and opacity at the expense of the consumer’s right to information and choice.

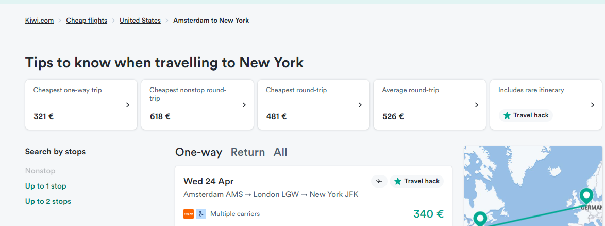

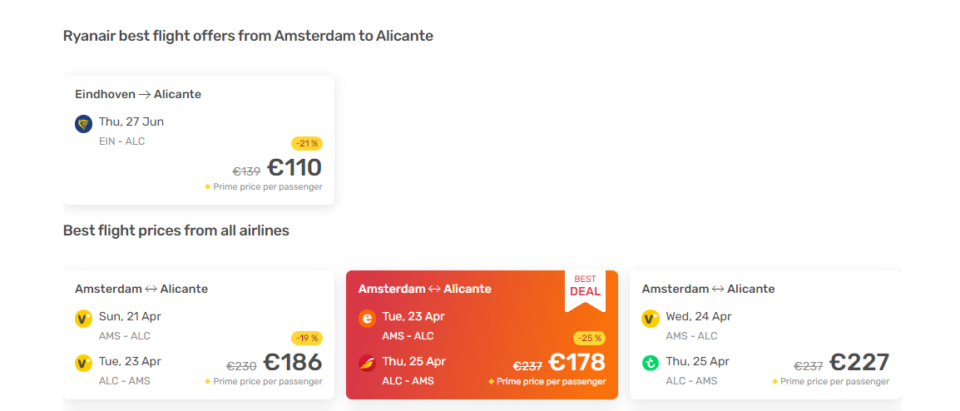

The price presented in the intermediaries’ offers displayed also needs careful consideration. Intermediaries’ offers, which can appear as “attractive” for consumers, often display a price typically lower than the airline’s direct offer. Yet, it is common practice for these intermediaries’ offers to present upfront a price undercutting airlines’ offers, only for them to then charge the consumer hidden fees and mark-ups – which are absent from the airline’s equivalent offers – and realise a profit at their expense. The extra-fees applied by intermediaries can represent a hidden mark-up of up to 216% for seat reservation or bag allowance.Edreams overcharging Italian consumers by +216%, Ryanair, News

Should the DMA implementation result in the removal of the airline box, European consumers would have less visibility and clarity of choice between intermediaries and airline offers compared to their counterparts in third countries not subject to the DMA: to the end result of the DMA cannot be that consumers outside of the EU have better clarity as to the different types of offers available, also creating a competitive disadvantage for European airlines.

The pursuit of an alleged level playing field, at the expense of a level playing field for airlines

Article 6(5) of the DMA related to ‘self-preferencing’ requires for the targeted gatekeepers to “apply transparent, fair and non-discriminatory conditions” to their offers’ ranking. Although those principles are supposed to encourage competition by mitigating the impact of gatekeepers’ practices and may not directly apply to intermediaries in this text, A4E believe that there should be more coherence in the digital legal framework and between the rules applying to gatekeepers and intermediaries.

Having the implementation of the DMA further entrenching intermediaries’ economic power and favouring their offers at the expense of direct suppliers’ should be considered as unfair and discriminatory. Yet, as it is currently being implemented, the DMA opens the gate to possible unfair practices from other intermediaries and ticket distributors.

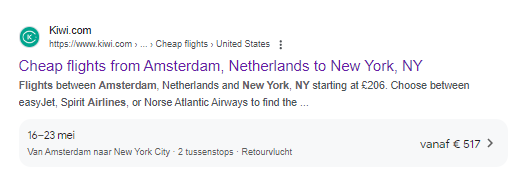

Intermediaries already manipulate their offers and apply unfair practices to mislead and attract users at the two stages of their search: first they will use titles and subtitles on the search engine to get more clicks (i.e., ‘clickbait’ tricks) – although it is incorrect fare information or it does not match consumers’ research – and then on their own website they will undercut airline offers to get a better position and display, resulting in an unfair and unequal ranking.

Due to the lack of regulation on the matter, MSEs as well are free to display offers in the way they want and to deliberately favour intermediaries’ offers. For instance, most of the offers Kayak is displaying are OTAs’ – which, again, is very hard for consumers to identify – and Skyscanner typically only presents one airline offer out of the ten proposed. This lack of distinction is being strengthened by the fact that MSEs and intermediaries themselves be part of the same group such as Trip.com and Skyscanner, be owned by another intermediary or MSEFor instance, Booking.com owns Kayak, or have partnerships with one anotherFor instance, Booking.com and Kiwi.com which are converging towards a homogeneous model thus favouring their own offers. The following example illustrates this increasing blurred line between what constitutes an MSE and an OTA:

Travel intermediaries are an industry worth billions of euros in Europe alone. Such companies are often foreign-owned and non-EU companies, such as the American companies Expedia and Booking Holdings or the Chinese Trip.com Group. In addition to constituting a missed opportunity to contribute to the EU economy, this raises potential concerns from a strategic autonomy perspective should these companies’ market power be reinforced as a result of the DMA implementation. Additionally, Booking.com, which recently notified the Commission of its potential DMA gatekeeper status, already has a dominant position in the hotel intermediary sector, made no secret of its intention to expand its dominance to the entire travel sector and is already one of the five biggest OTAs.Mordor intelligence, Europe Online Travel Market Size & Share Analysis – Growth Trends & Forecasts (2024 – 2029)

Finally, the implementation of DMA’s obligations should stay coherent with other obligations targeting intermediaries. In addition, as seen in the latest passenger rights proposal issued by the Commission, the latter is currently invested in ensuring a “clear reimbursement procedure”.Proposal for a Regulation of the European Parliament and of the Council amending Regulations (EC) No 261/2004 as regards enforcement of passenger rights in the Union (Omnibus proposal) Consequently, it should take into account the need for a clear booking procedure offering easily accessible information as to the content and type of offers.

Key asks

Consequently, A4E is asking for the Commission to:

- Make sure the DMA’s goals are achieved while still protecting a competitive landscape for the aviation industry.

- In the absence of fair display of airlines’ direct offers on other comparing website, ensure that airlines’ offers are distinguished from intermediaries’, with a clear and prominent display on the Google search page. This requires directly displaying airlines’ offers including both flight options and prices in an “airlines block” or any other relevant mean (e.g. labels). This would maintain high-quality search results which meet the highest standards, while providing consumer with a useful, helpful, and informative experience.

- Take into consideration the elements detailed above while conducting Alphabet’s non-compliance investigation.

- Include the airline industry in future workshops and competition consultations on the matter in order to make sure to have a fair and balanced stakeholder representation for the whole distribution landscape.