One of the issues that has come onto the EU’s agenda in recent times is how travel offers are made available to consumers. Just like every other issue in Brussels, there are different sides of the debate and both are looking to defend and potentially improve their commercial interests. So we have seen online travel intermediaries like Booking.com, Kiwi or Skyscanner, spearheaded by their association euTravelTech, become particularly vocal in Brussels on legislation ranging from MDMS to the implementation of the Digital Markets Act (DMA). Some of the arguments they have deployed include the absolute necessity for airlines to share their content with them, their critical role in sustainability through to the rather outlandish claim that intermediaries are entitled to full access to merging airline content to improve competition. They deserve full marks for the creativity of their efforts and the narrative they are trying to establish.

But when it comes to intermediaries there’s a danger we do not see the wood for the trees. The narrative that is being presented is a disingenuous attempt at commercial gain at the expense of consumers. We have repeatedly heard from intermediaries that placing obligations on airlines for sharing their content is required to enable consumers to easily compare travel options. In reality, airline offers are already easily comparable and accessible for European consumers due to the wide range of comparison websites that exist and the fact that all major European airlines conclude freely negotiated agreements with intermediaries. The only thing content sharing obligations for airlines would achieve is a distortion of the balance of power underlying airlines and intermediaries. The knock on effect would be that European consumers would have even greater exposure to intermediaries’ dubious consumer protection standards.

The Commission (DG JUST) and national consumer authorities have already identified harmful business practices among travel comparison and booking platforms: there are instances of unauthorised extraction of flight data from airline websites, lack of price transparency and hidden excessive mark-ups. A recent survey showed the magnitude of intermediaries’ hidden fees and mark-ups. For example, ancillary services purchased through intermediaries can be over 200% more expensive than on the airline websites or simply not offered at all. Intermediaries also regularly fail to share customer contact and payment details with airlines and fail to inform the consumers when they face travel disruption; contrary to EU261 principles and something which dilutes passenger rightsSee, for instance, the “sweep” of travel comparison and booking websites conducted in 2016, available here, and the coordinated action against airline intermediaries in 2022-23, available here. These shortcomings on consumer protection should be carefully taken into account before considering content sharing obligations for airlines.

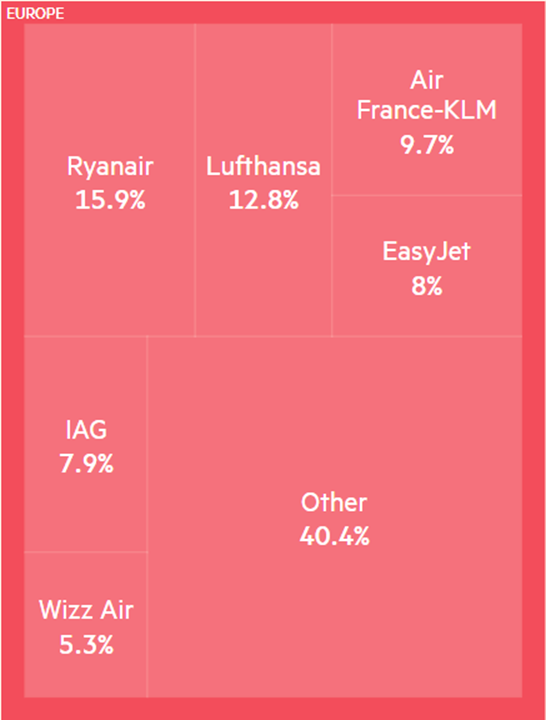

But it doesn’t stop there. We have seen intermediaries begin to wade in on airline competition issues, despite the fact that one of the leading examples, Booking.com, accounts for over 70% of the hotel accommodation marketHOTREC (2024), “Booking.com soon to be designated as Gatekeeper”, available here. In contrast, the market share of Europe’s five largest airlines amounts to only 54,3%Financial Times (2023), “European airlines in deal drive to boost profits and open up routes”, available here. Booking.com, which has made no secret of expanding its dominant position to the entire travel sectorBooking.com (2023), “How Booking.com is creating the connected trip”, available here, is already one of the largest online travel agents (OTA) for air tickets. Recently, the company saw its attempted acquisition of eTraveli, another major OTA, blocked by the European Commission due to competition concernsEuropean Commission (2023), “Mergers: Commission prohibits proposed acquisition of eTraveli by Booking”, available here. Something to mull over the next time you hear intermediaries complain about a lack of competition in air services.

Strong competition among airlines, facilitated by easily accessible and comparable air travel options, have allowed for more consumer choice and lower fares for millions of Europeans. These consumer benefits must be preserved by enabling airlines to continue to distribute their services as they see fit. Air carriers can and do work in partnership with many OTAs. Indeed, there has been a spate of announcements by some airlines recently about such partnerships. However, the success of such arrangements is based on mutually beneficial, freely and fairly negotiated business agreements. For passengers, airlines and intermediaries alike, let’s keep it that way.