Airlines for Europe (A4E) is Europe’s largest airline association. Based in Brussels, A4E works with policymakers to ensure aviation policy continues to connect Europeans with the world in a safe, competitive and sustainable manner. With a modern fleet of over 3,600 aircraft, A4E airlines carried over 718 million passengers in 2023 and served nearly 2,100 destinations. Each year, A4E members transport more than 5 million tons of vital goods and equipment to more than 360 destinations either by freighters or passenger aircraft. A4E is #FlyingForOurFuture with our commitment to Europe and our call to action for incoming policymakers. Find our more at flyingforourfuture.eu

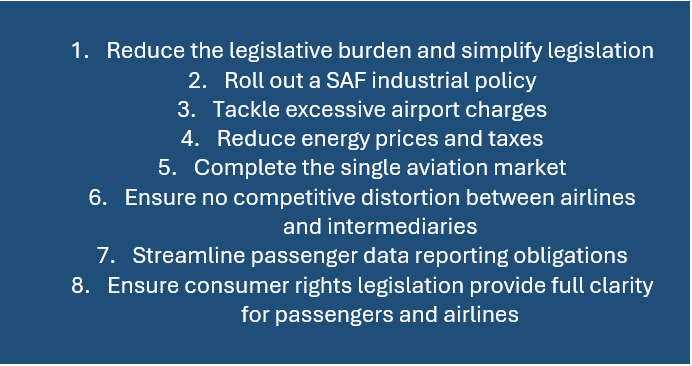

Regulatory incoherence, lack of clarity in rules, unnecessary complexity in legislation and over-reporting dent the sector’s competitiveness. Corrective measures on a series of existing EU regulations need to be urgently presented. There are numerous administrative requirements in EU air transport legislation that can be adjusted without undermining policy objectives:

- ENVIRONMENTAL LEGISLATION

The EU has set out world-leading ambitions to decarbonise its economy. European airlines are fully committed to playing their part to achieve this vital goal. Yet reaching our ambitious climate targets represents a significant challenge and numerous new burdens. It also constitutes a competitive disadvantage for European air carriers on the global stage. Environmental regulatory obligations should be made as efficient and manageable as possible, while still meeting their intended objectives.

There is significant potential to streamline obligations for sustainable aviation fuels (SAF) and environmental reporting. We need a regulatory framework that helps ramp up the production of SAF and provides incentives for SAF use, also beyond mandated levels. A smooth interplay between the different relevant legislations is key; consistency between ReFuelEU Aviation (Regulation 2023/2405), the revised Renewable Energy Directive (RED, Directive 2023/2413) and the amended legislation on EU ETS for aviation (Directive 2023/958) is a must.

These rules need to be coherent and aligned with general sustainability reporting and accounting standards. The ETS Directive rules need to cater for a changing industry with higher SAF uptake which cannot be traced on each flight: the monitoring and reporting rules should provide for unambiguous and timely alignment on the eligibility of fuels, i.e. the SAF definition and scope as set out under ReFuelEU Aviation, which should take account of any future adjustments and extensions due to changes in the overarching RED framework.

Such facilitation of reporting and traceability could occur through a single EU registry as in the RED Union Database (UDB) for biofuels. It would reduce the administrative burden and avoid double claiming and fraud by centralising all relevant information related to SAF including their environmental attributes. This approach would allow for effective implementation of the obligations of both fuel suppliers and airlines with a minimum administrative burden.

The Commission is also setting up a Monitoring Reporting and Verification (MRV) system for non-CO2 effects of aviation. Any monitoring and reporting of non-CO2 effects should be subject to an examination of the technical feasibility and involve a stakeholder & technical consultation, ensuring parties best positioned to efficiently provide data (airlines, EUROCONTROL or EASA and others, as suitable) are involved in the process. While some of the non-CO2 components considered may be available today (e.g. temperature, flight trajectory), other data does not originate from airlines, while others would require vast amounts of data (e.g. flight trajectories) and some currently cannot be collected at all due to a lack of technical solutions (e.g. humidity, NOx, soot particles, sulphur oxides, contrail formation).

Considering the short timeframe for the implementation of the legislation, and the significant lack of transparency and absence of stakeholder engagement, it is vital not to rush the release of an unfinished framework that is difficult to understand, costly to implement, and lacking accuracy. As the collection of data will rely on highly sophisticated software, the development should include aircraft operators on every step of the way. Despite a looming deadline and considering NEATS is yet to be released, this has not happened to a sufficient extent. As it is doubtful that the current trajectory will lead to a satisfactory start of the MRV by 1 January 2025, the Commission should consider limiting itself to a sampling approach covering a reduced number of flights initially.

2. EXCESSIVE AIRPORT CHARGES

Excessive airport charges drive up airline costs, impacting the cost of travel and consumer choice in Europe. Greater regulatory oversight of airports with significant market power would improve the competitiveness of airlines. It would ensure that airlines and passengers don’t pay more than they should for the use of airport infrastructure. Airport investments should be cost-efficient and supported by a solid business case.

In addition to airport charges levied under Directive 2009/12/EC (‘airport charges directive’), airlines also encounter a significant lack of transparency in price-setting by providers of ‘centralised infrastructures’, such as fuel distribution systems, de-icing, baggage sorting systems, and water purification, as defined in Directive 96/67/EC (‘ground-handling directive’). As these providers often enjoy local market monopolies, it is crucial that any future revision of the legislation strengthens price transparency by mandating prior airport user committee consultations in the same manner as for airport charges.

To support an efficient aviation market and air connectivity for Europeans, A4E recommends a reform of the EU’s regulatory framework and the Airport Charges Directive to make the rules clearer and more robust.

3. DISTRIBUTION AND THE ROLE OF ONLINE INTERMEDIARIES

Whether through the Multimodal digital mobility services (MDMS) proposal or via the implementation of the Digital Markets Act (DMA), intermediaries have become a more visible consideration in the transport policy mix.

It is of paramount importance that airlines retain the commercial freedom to distribute their own services as they see fit and that consumers maintain easy access and to direct airline booking channels from intermediaries.

Under any scenario, it is essential that key requirements from the CRS Code of Conduct, such as a neutral display, are retained, and that B2B intermediaries are required to comply with FRAND (fair, reasonable and non-discriminatory) principles when entering into commercial agreements with travel operators.

4. CONSUMER RIGHTS

The current passenger rights legal frameworkRegulation (EC) No 261/2004 of the European Parliament and of the Council of 11 February 2004 establishing common rules on compensation and assistance to passengers in the event of denied boarding and of cancellation or long delay of flights. is imbalanced and has been expanded far beyond its original scope by the courts. This has resulted in an overly complex and costly system rather than creating clear rules that can be swiftly understood and applied, benefiting consumers and allowing airlines to allocate their resources to getting people to where they want to go rather than dealing with countless legal disputes.

In 2020, the EC published a studyStudy on the current level of protection of air passenger rights in the EU, Steer and DG MOVE, September 2020. on the current level of protection of air passenger rights in the EU, highlighting the shortcomings of the current framework. A higher rate of disruptions, especially air traffic control-related delays, and a lack of clarity on key issues such as extraordinary circumstances (force majeure), has a major impact on airlines. The study estimated that EU261 compliance costs amounted to €5,3 billion in 2018. A more recent analysis estimated the cost of delays and cancellations for EU airlines would increase from €8,1 billion in 2019 to €9,2 billion by 2030.See page 31 of the impact assessment for the new passenger rights proposals published in November 2023. Available here: https://transport.ec.europa.eu/document/download/8cb27631-d582-421d-9f72-d0a59971020f_en?filename=SWD_2023_386_impact_assessment.pdf

The burden that it creates on airlines and the need for more legal certainty calls for progress in the revision of Regulation 261/2004 on air passenger rights. A4E supports the Commission’s 2013 proposal as a good basis for reform, which would lead to fewer disputes, reduce costs for all parties, and help passengers to assert their rights, supporting efficient mobility in Europe.

As part of the Passenger Mobility PackagePublished in November 2023. See: https://transport.ec.europa.eu/news-events/news/passenger-mobility-package-2023-11-29_en, the Commission has recently proposed new service quality standards and reporting requirements for airlines under Regulation 261/2004, Regulation 1107/2006 on passengers with reduced mobility, and a new multimodal passenger rights law. These requirements represent an additional administrative burden at a time where the Commission’s stated aim is to reduce red tape for businesses and support European competitiveness.

5. SUSTAINABLE FINANCE

The EU’s Sustainable Finance Taxonomy creates significant administrative burdens, requiring an immense annual effort to align business activities with the screening criteria to demonstrate green credentials of assets. While well-intended in its purpose, it currently lacks simplicity and practicability due to the substantial contribution criteria and ‘Do No Significant Harm’ (DNSH).

The question is whether the requirements are useful and meaningful for the users, i.e., investors. We encourage the Commission to consider reducing the mandatory KPIs, such as the OpEx KPIs information, possibly making it optional for airlines. Other types of improvements could include the requirement to report only those activities to be financed through sustainable finance.

6. PASSENGER DATA AND BORDER CONTROL

In recent years, the EU has launched several initiatives to strengthen its security architecture and combat irregular migration while preserving the Schengen free movement area. Initiatives reinforcing controls at external borders and passenger data collection should not cause disproportionate waiting times nor unnecessarily hinder passengers flows. An efficient implementation of electronic travel systems, designed to enhance border security while contributing to the identification of potentially inadmissible passengers before boarding must consider impacts on passenger facilitation and be aligned with existing operational systems and processes.

New Advance Passenger Information (API) and Passenger Name Record (PNR) proposalsProposal for a Regulation on the collection and transfer of advance passenger information for enhancing and facilitating external border controls, amending Regulation (EU) 2019/817. Proposal for a Regulation on the collection and transfer of advance passenger information for the prevention, detection, investigation and prosecution of terrorist offences and serious crime will constitute the foundation for API data transfer obligations. Under these two regulations, airlines will face obligations to transmit API data at the time of check-in and once again before boarding – failure to do so will leave them exposed to significant financial penalties. Meeting the above reporting obligations will result in significant duplication, carrying additional costs and operational burden for carriers. Steps must urgently be taken to set up a harmonised approach for passenger data transmission.

Avoiding duplication of requirements, ensuring the rules apply equally to all transport modes and refraining from punitive approaches will be crucial to ensure the competitiveness of the sector.

7. UNION CUSTOMS CODE

Reforming the Union Customs Code, creating a single EU interface and facilitating data re-use will be incredibly important to determine any potential cost savings for traders. Certain proposed changes are contrary to simplification such as the removal of the customs duty de minimis (which will increase red tape at the border) or the reduction of the maximum period for temporary storage from 90 to 3 days. The removal of de minimis exemptions may antagonise EU trading partners and harm the Union’s position as an advocate for liberalised trade, leading to negative effects for European exporters and cargo carriers.

The efficient use of data would offer a clear advantage compared to today’s IT landscape with many different systems and national characteristics. National requirements need to align with a potential EU-wide set-up.

The creation of an independent EU Customs Authority, which would support the uniform application of EU customs regulations, is a particularly valuable element of the reform. However, it is important that its role and the role of National Customs Authorities are clearly defined to avoid overlapping responsibilities and duplications. This should ensure an efficient and effective structure of competences, responsibilities, and rights of intervention.

European airlines remain committed to making Europe’s skies the most sustainable in the world. Yet, costs linked to the implementation of the Green Deal and associated legislations are constantly increasing. This financial burden for airlines will negatively impact the competitiveness of the aviation sector and their ability to making air travel available to as wide a population as possible.

European airlines stand in direct competition with third country operators. All rules, thresholds, and mechanisms must be carbon-leakage proofed and guarantee a level playing field both for cargo and passenger flights. International agreements like CORSIA must be strengthened to move towards a global level playing field and to effectively address aviation’s CO2 emissions.

1. ENERGY PRICES

SAF, which are poised to become aviation’s main energy source in the coming decades, will remain 2-3 times more expensive in Europe than jet fuelDestination 2050 Roadmap, NLR/SEO, March 2021. The US Inflation Reduction Act (IRA) is putting in place massive support for SAF through various incentive mechanisms: tax credits for producers and distributors as well as grant schemes. China is also aggressively supporting development and deployment of clean technologies. We urgently need the same level of support in the EU.

To date only the EU’s SAF allowances provided for in the revision of the aviation ETS, and which cover part of the price difference with kerosene, appear comparable. But their size is too limited and they fall far short of the IRA SAF provisions. In addition, carbon taxes specific to the EU and national ticket taxes do not exist in the US, China or the Middle East. This will result in a concentration of efforts on clean tech deployment in places other than Europe e.g. with SAF/hydrogen more expensive in Europe than in the US. Whereas other regions emphasize the “carrot” to incentivise a clean energy transition, the debate in Europe has almost exclusively focused on a “stick” approach. Maintaining this approach will come at the expense of the European economy and its decarbonisation strategy whilst making air transport more expensive in Europe for both citizens and industry alike.

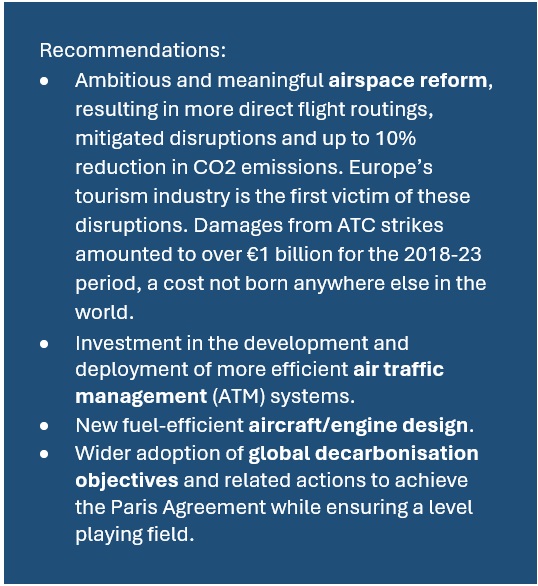

2. CONDITIONS FOR A COMPETITIVE DECARBONISATION

A global level playing field is needed to make sure Europe is not put at a disadvantage compared to the rest of the world. Achieving a truly integrated Single European Sky through ambitious reform must remain a priority following the disappointing conclusion of SES2+ discussions. A meaningful airspace reform can help our industry reduce delays and CO2 emissions, enabling us to compete on equal ground with the rest of the world.

Another priority for the EU is to address the fragmented and permanently disrupted airspace due to air traffic control (ATC) strikes, which dents Europe’s competitiveness. Ensuring the adoption of harmonised mitigation measures for ATC strikes across the EU will ensure predictability for airlines, passengers and controllers alike while also preserving Europe’s freedom of movement.

The Green Deal will increase the average ticket price per passenger for return flights in 2030 and 2035. For short-haul flights (for a total distance of 1,500 km) the average ticket price increase goes up from €23 in 2030 to €31 in 2035. This implies a respective price increase of 15% and 21% relative to an illustrative €150 return ticket. For medium-haul intra-EEA flights, cost developments are similar in relative terms. The average ticket price increase goes up from €45 in 2030 to €63 in 2035. For 6,000 km return flights going between a European and a non-European airport, the ticket price increase consistently goes up over time. By 2030, the cost increase averages €14 and afterwards, by 2035, the average cost increase is expected to be €33 per ticket. The relative price increases are 2% and 6% respectively, when starting with a €600 return ticketAviation costs of the EU’s Fit for 55 Proposals, SEO Amsterdam Economics and NLR, August 2022 LINK.

The decarbonisation of the EU’s economy cannot come at the cost of European businesses remaining competitive. A4E supports the objectives and framework of the carbon border adjustment mechanism (CBAM) and its relevance in driving emission abatement measures in a competitive international environment, without infringing on the rights of established and valued trade partners. Deployment of solutions that enable the decarbonisation of aviation should remain the centrepiece of future efforts. A level playing field and carbon mitigation mechanism need to be developed.

3. ENERGY TAXATION

The EU is currently debating an intra-EU aviation fuel taxEuropean Commission, Proposal for revising the Directive 2003/96/EC on the taxation of energy products and electricity presented on 14 July 2021. a Council directive restructuring the Union framework for the taxation of energy products and electricity, COM(2021) 563. Much has been made of the amount of revenue this will raise, but the discussion loses sight of the wider effects such a tax might have. While some may see short-term budgetary gains, the tax will ultimately have a significant negative impact on local economies, particularly those reliant on tourism, and will distort the Single Market. This will harm jobs and can push tourism out of Europe to neighbouring destinations which do not apply this additional tax, leading to negative long-term effects. In 2033, Spain, Portugal and Italy could lose respectively 8.7%, 9.5% and 6.1% of their air passengers (compared to 2019), with a diversion rate to non-EU destinations varying between 19.5% and 50%Steer, Economic Impact Assessment of Energy Taxation Directive on Travel and Tourism in Europe, December 2023..

An EU aviation fuel tax threatens European tourism, jobs and the EU’s economy, but it will not help decarbonise aviation and neither would national ticket taxes. A4E airlines’ cost of compliance to national aviation taxes amounted to €4 billion in 2022. These costs are expected to increase in the coming years following the adoption of new aviation taxes in France, Italy, and Denmark. These national aviation taxes will not contribute to environmental goals, as little to none of these revenues will be reinvested in decarbonising the sector. The Danish Government has for example explicitly stated that two third of the tax will go to geriatric care. Decarbonising the sector should be the primary focus amongst Member States and the EU.

Air cargo is an essential part of Europe’s prosperity. Steady globalisation secures sustainable demand for air cargo with Europe sitting at the intersection of global trade. For Europe, it accounts for nearly 30% of exports and 25% of imports in value termsEurostat, International trade in goods by mode of transport, in Globalisation patterns in EU trade and investment, 2017 edition, last modified 7 September 2018. Air cargo also plays an invaluable role during global crises, pandemics, and supply chain disruptions, as well as being a key enabler of European imports and exports.

Global industrial production and cross border trade have surpassed pre-pandemic levels by 9.2% and 6.5% respectively. Global air cargo is following suit, reaching 103.4% in December 2023 compared to pre-pandemic figures. On the European side, carriers saw an increase in volume of 16.9% in January 2024 compared to 9.2% in December 2023IATA, Retrieved from: https://www.iata.org/en/iata-repository/publications/economic-reports/air-cargo-market-analysis-january-2024/ACI, Retrieved from: https://aci.aero/2023/07/19/aci-world-confirms-top-20-busiest-airports-worldwide/.

Amid this global post-pandemic recovery, European carriers continue to face pressure. There is still no European airport in the top 10 global ranking of international cargo airports: Three airports (Frankfurt, Paris Charles de Gaulle and Leipzig) are in the top 20 and amidst rising global competition, stronger commitment from the EU to its air cargo industry is now needed. These pressures are as much the result of complex EU regulations and how they are implemented by Member States, as of the high operational and infrastructure costs.

European cargo carriers also face distortions of the internal market through an uneven acceptance of ACC3 security screenings and security audits by Member States. Currently, each national authority is responsible for validating such screenings and audits, leading to a fragmented market in which some non-EU airports are accepted by certain authorities, while being rejected by others. This effectively enables some EU carriers to service certain airports which other carriers cannot, creating an undue market distortion. In a context of global geopolitical uncertainty but ever-growing demand for air cargo in Europe and around the world, it is essential that measures be taken to preserve and enhance the competitiveness of the sector for the benefit of European consumers and businesses.